Wealth-creation is surprisingly simple! All you’ve got to do is spend less than you earn and invest the rest. Of course, the practical application of this principle is a little harder – especially if you’re living from paycheck to paycheck currently and you can’t see any spare cash in your budget to invest.

But don’t let that put you off…

Chances are you can create some extra wealth without earning a dollar more.

First, review your expenses [LEARN MORE HERE]

Then review the way you allocate your income and adopt the 50/30/20 rule.

What is the 50/30/20 rule?

The 50/30/20 rule is a series of high-level ratios that help you allocate your income so you can optimise your wealth and create the finances you need to live the life you want.

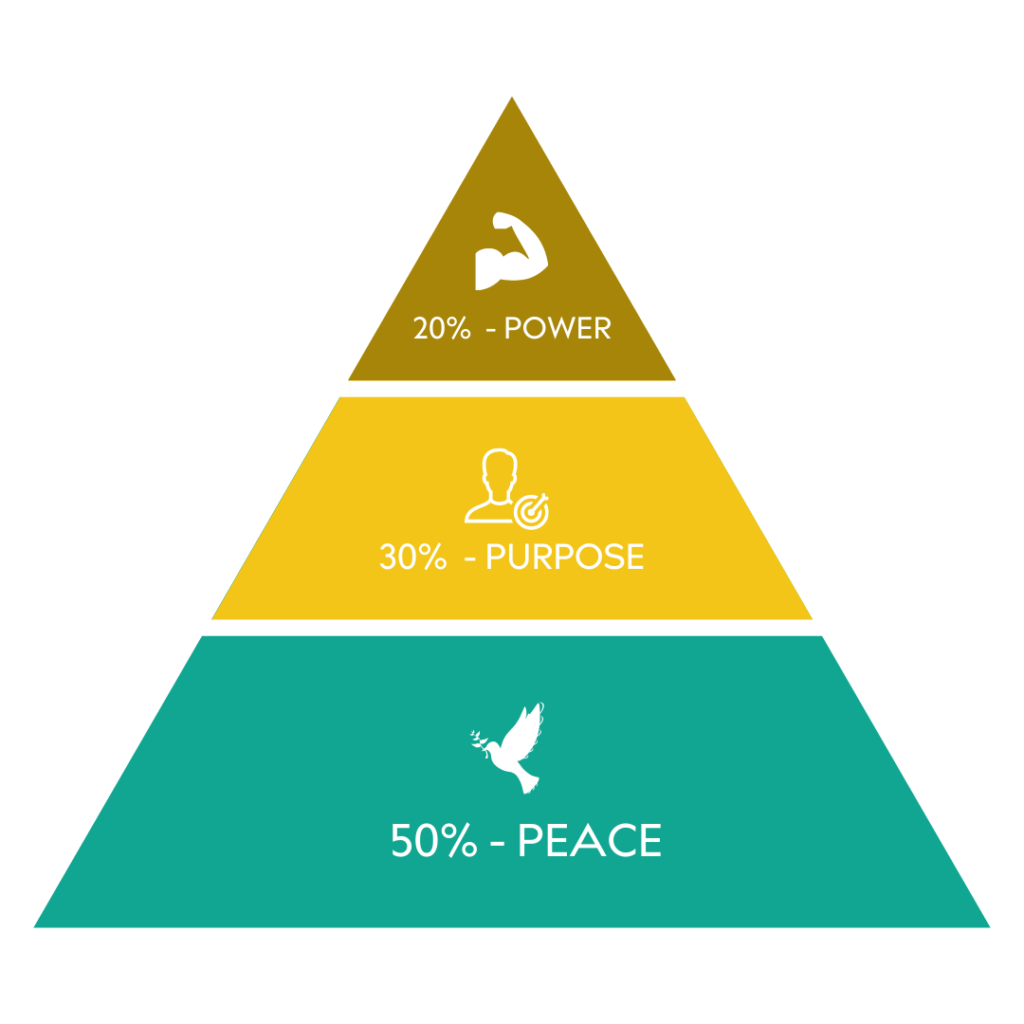

Aligned with Maslow’s Hierarchy of Needs, the 50/30/20 rule ensures your money is supporting your life in terms of what you want today – and tomorrow as well as providing for your individual wants and needs.

Here’s what falls into each of the three wealth categories:

• 50% goes to your monthly NEEDS: Needs are your essentials – the things you HAVE to pay for and includes stuff such as your rent/mortgage, food, utilities and other bills, plus insurance, healthcare, transport, and any minimum debt payments.

• 30% is your personal spending and WANTS: Your personal spending budget is for you to spend as you please and includes the non-essential things that you want – for example, eating out, socialising, shopping, gadgets etc. This category also includes holidays and experiences as well as monthly subscriptions and memberships that are optional.

• 20% goes to savings, investments and debt: This category represents investments in your future wealth. If you have debt, include any repayments above the minimum amount in this category. Also include payments to your:

- Get Out Of Jail account

- Investment accounts

- Savings accounts

When you allocate your income with a 50/30/20 split, you’ll turn your money into a source of peace, purpose, and power. Here’s how:

• PEACE – give yourself certainty that all your monthly essentials are covered and you’ll create financial peace of mind. When you don’t have to worry about money on a day-to-day basis, you free up a ton of headspace and creative energy to use elsewhere in your life.

• PURPOSE – allocate a personal spending budget, and you’ll have the resources to do more of the things you enjoy – guilt-free!

• POWER – while money doesn’t directly buy happiness, wealth does create more choice, giving you more control over your life – now and in the future. Build your ‘power’ fund, and you’ll create a lot more flexibility for yourself and your life.

How to use the 50/30/20 rule to build wealth

1.FIRST, OPEN THE TOOL

2.FIGURE OUT YOUR ALLOCATIONS USING THIS FREE 50/30/20 TOOL.

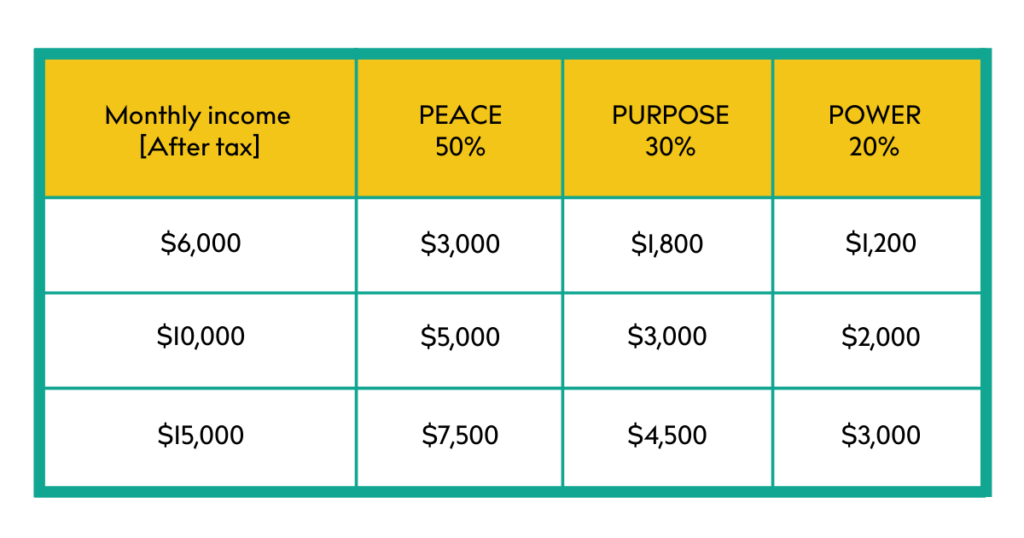

Simply input your monthly salary [after tax] and discover the total amount you ‘should’ allocate to each category each month.

Here are some examples of what your allocation could look like depending on your income.

3. CALCULATE YOUR VARIANCES

Next, look at your actual spending to discover how close your current habits are to the 50/30/20 rule. Again, you can use the 50/30/20 Tool to help you do this.

4. ADJUST YOUR EXPENDITURE TO MAKE IT 50/30/20 ALIGNED

Are you spending too much in the 30% bucket? Are you falling short of the 20% target for investments and savings? If so, have a play with your expenditure to see what you can cut and free up.

Break the rules!

Remember, the 50/30/20 rule isn’t set in stone. Instead, it’s a guideline to help you allocate your monthly income for maximum wealth. It’s a tool that can guide you to make better financial decisions, so that you can walk the wealthier path through life.

For example:

- If your monthly essentials far exceed the 50% suggested allocation, you can review your monthly outgoings to free up wealth.

- If you’re far short of a 20% POWER allocation, you may feel inspired to make cuts elsewhere so you can divert your money into wealth-creation opportunities.

Remember, your personal circumstances could mean that your allocation deviates from the 50/30/20 rule. For example

- Living costs in your city may be higher than average, meaning your PEACE bucket needs more than 50% of your allocation.

- If you’re paying down debt or saving for something bigger, you may want to sacrifice some of your PURPOSE money to boost your POWER bucket.

The secret is to ensure your allocation aligns with your values and intentions.

Start TODAY

It’s a fact that the right strategies, mindsets, and behaviors can transform your financial situation – often quicker than you think.

So if you’re frustrated by the scale of your assets and you want your money to go further each month, take action today.

Use the 50/30/20 Tool to take control of your wealth creation and kick-start your prosperity path to more abundance, freedom and happiness!